Produced by DLG (Digital Luxury Group), an international digital marketing and communications agency for luxury brands, the WorldWatchReport Benchmark analyses the online performance of luxury watch brands exploring topics ranging from the role of a brand’s website and the impact of social media on drive-to-store, to the importance of balancing owned and earned media.

“The WWR Benchmark is a unique report providing comparison points on all major web analytics indicators for the luxury watch industry. It helps brands better position their investments to maximise their digital ROI,” explains Yoann Chapel, Head of Client Services at DLG.

Data-Driven Impact

This year’s panel includes more than 15 brands among the 62 eligible on the market and includes 135 million sessions that have been analysed for their 2017 performance.

DLG analyses data-driven statistics to decipher the most compelling and impactful statistics ranging from traffic growth to advertising to product pages.

The Chinese Consumer

In 2017, the biggest share of traffic to luxury watch websites came from China. China is currently the leading market over the United States, with a 15.2 percent market share.

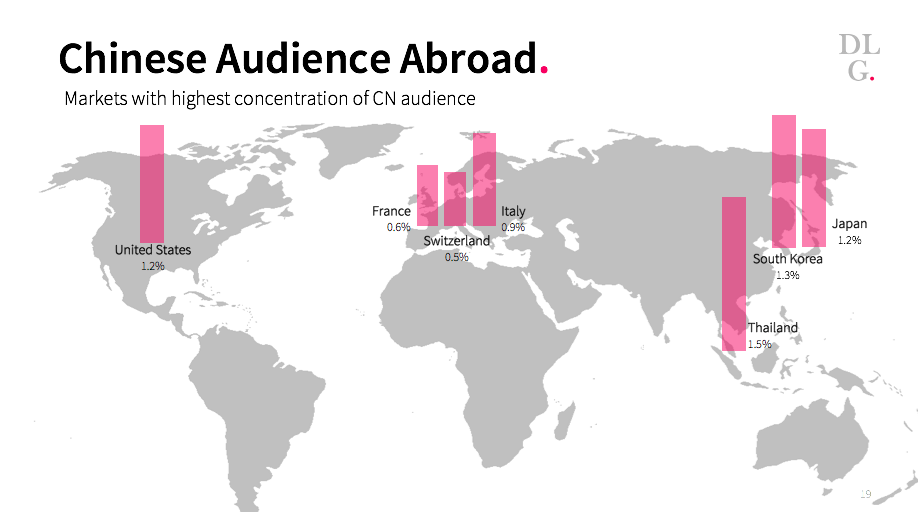

Looking at Western markets, between 0.5% and 1.2% of the traffic to luxury watch websites is performed from browsers (e.g. Internet Explorer, Safari…) configured in Mandarin Chinese.

The Chinese audience abroad is powerful and should not be overlooked when it comes to global brand strategy. The top four markets with the highest concentration of Chinese audiences include Thailand, South Korea, Japan and the U.S.